EDUCATION

“Accounting is the language of business, and you have to be as comfortable with that as you are with your own native language…”

-Warren Buffett

Understanding Business Basics: Accounting A 5-Part Mini Series

Choosing a Business Entity

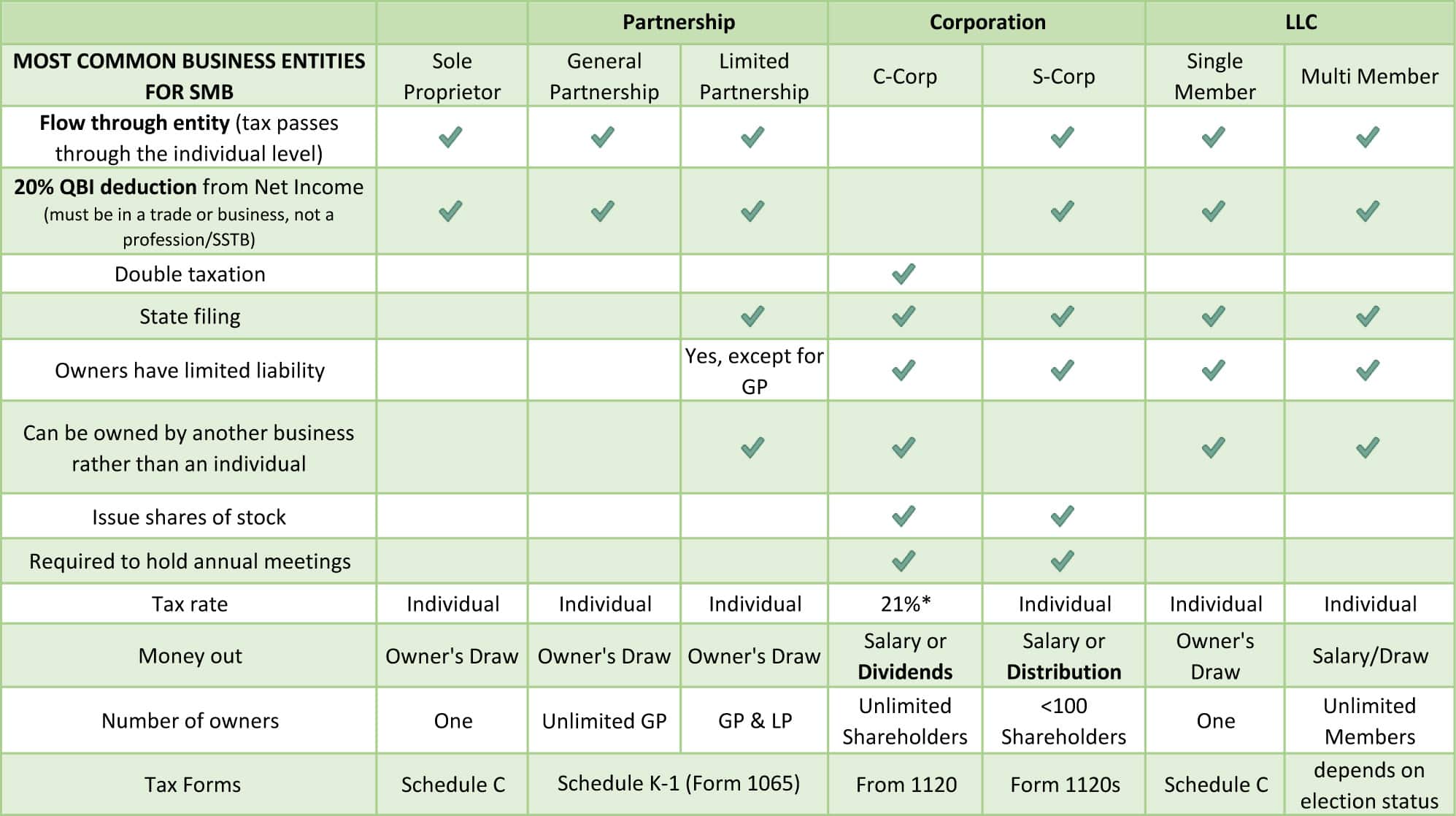

There are several types of business entities, each with its own tax & liability advantages and disadvantages. Here are the most common types:

- Sole proprietorship: This is the simplest form of business entity, owned and operated by a single individual. The owner is personally responsible for all aspects of the business, there is no legal separation between the owner and the business, and the business income and expenses are reported on the owner’s personal income tax return (Form 1040, Schedule C).

- Partnership: A partnership is a business owned by two or more individuals who share in the profits and losses of the business. The partnership itself is not taxed separately from the partners, and the business income and expenses are reported on each partners’ personal income tax returns (Form 1065, Schedule K-1). There are several types of partnership which includes:

- i. General partnership: In a general partnership, each partner contributes to the business, shares in the profits and losses, and is personally liable for the partnership’s debts and obligations.

- ii. Limited partnership: A limited partnership has both general partners and limited partners. The general partners manage the business and are personally liable for the partnership’s debts and obligations, while the limited partners contribute capital but have limited liability.

- iii. Limited liability partnership (LLP): An LLP is a type of partnership in which all partners have limited liability for the partnership’s debts and obligations. LLPs are often used by professionals, such as lawyers and doctors who operate their own practices.

- Limited Liability Company (LLC): An LLC is a hybrid business entity that combines the limited liability protection of a corporation with the tax flexibility of a partnership. LLCs can be owned by one (Single-member LLC) or multiple (Multi-member LLC) members and are managed by either the members or managers. An LLC can be taxed as a partnership, a corporation, or a sole proprietorship, depending on how it is structured.

- C corporation: A C-corporation is a separate legal entity from its owners, and it is taxed at the corporate level. This means that the business income and expenses are reported on the corporation’s tax return, and the corporation may also be eligible for certain tax deductions and credits. However, C corporations are subject to double taxation, meaning that the corporation’s profits are taxed at the corporate level, and then again when they are distributed to shareholders as dividends.

- S corporation: An S-corporation is a type of corporation that meets certain eligibility requirements to avoid double taxation. S corporations are not taxed at the corporate level, and the business income and expenses are reported on the owners’ personal income tax returns. S corporations are often preferred by small businesses because they offer limited liability protection and can help reduce the overall tax liability of the owners.

- Nonprofit: A nonprofit is a type of corporation that is organized for a charitable, educational, or religious purpose. Nonprofits do not have owners or shareholders and are governed by a board of directors.

Why it’s important

Choosing the right business entity is crucial for the success of any business as it can have significant legal, financial, and operational implications. Here are a few reasons why:

- Liability protection: Different business entities offer different levels of protection from personal liability for business debts and legal claims. For example, a sole proprietorship does not offer any protection, while a corporation offers limited liability protection.

- Tax implications: The business entity you choose can have a significant impact on your tax obligations. For example, a sole proprietorship is taxed differently than a corporation or a partnership.

- Operational flexibility: Different business entities have different structures, management styles, and ownership rules. Choosing the right entity can provide greater operational flexibility and ease of management.

- Funding and growth potential: Depending on the entity you choose, it can be easier or harder to secure funding or to grow your business. Certain entities like corporations have greater access to capital than others.

- Succession planning: Choosing the right business entity can make it easier to plan for the future and ensure the smooth transition of ownership in case of retirement or other life events.